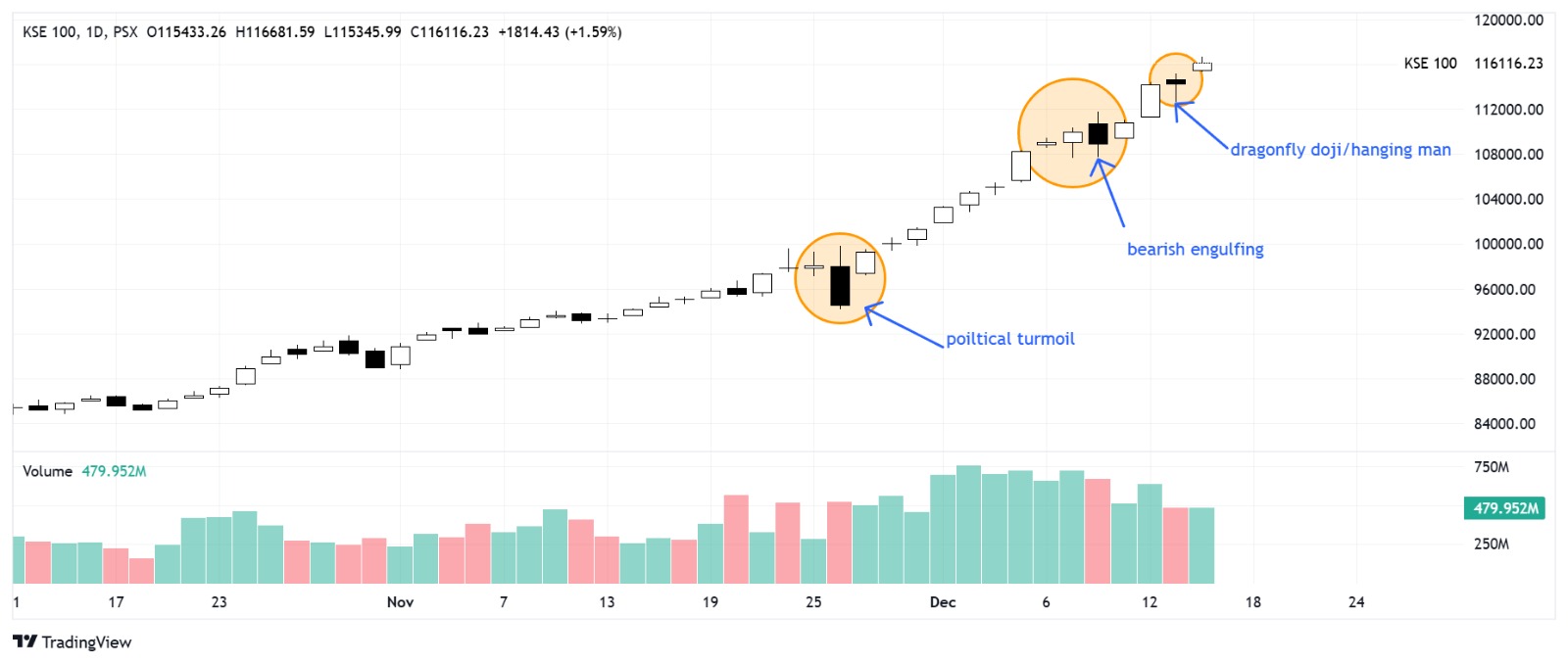

It’s interesting, and instructive, how casually the market continues to disregard short-term reversal Japanese candlestick patterns.

The last one appeared on Friday, 13 December 2024, when profit-taking (expected?) first pushed the market deep into red, forming a dark cloud cover pattern that held for most of the trading day before buyers came in towards the end and pushed the index up enough to close for a minor 121.30-point loss.

Yet while the dark cloud cover was avoided, the market still made a dragonfly doji/hanging man (ish) pattern, implying a short-term reversal nonetheless. But the market simply shrugged off any bearish implications when it opened on Monday, 16-12-2024, expecting a fat interest rate cut at the MPC (Monetary Policy Committee) meeting after trading hours, and continued with its merry bull run.

Earlier, on Tuesday, 10-12-2024, the market ran into profit-taking (again, expected?) just ahead of the 112,000-point psychological barrier and formed a classic bearish engulfing pattern. Since it came after a steep rise, it signalled at least a temporary reversal. Yet, again, the market paid no attention to the candlestick signal and gained about 5,750 points over the next two trading days.

Two is a trend, they say in the world of statistics, and since the market has rubbished serious bearish signals twice in one week, it seems a few indicators have come together at the same time to fuel the unrelenting market move to the upside.

1. Inflation for November clocked in at less than 5pc for the first time in 6.5 years.

2. The Saudi government rolled over its loans, helping state bank vaults look pretty, which means the UAE government will do the same

3. The political landscape seems clear enough not to disturb the market.

Remember the last great fall that was completely divorced from market fundamentals came on 26 November 2024, a 3505.62-point drop -- the day of the crackdown on PTI’s agitation in Islamabad. And even though the main opposition party is calling for more disruptions, including a civil disobedience movement, few people are taking it seriously.

Mr Market, especially, does not see it as a credible threat in the near future. That’s why it will be interesting to see the Index’s reaction to any technical/candlestick hiccups in the days and weeks ahead.

Disclaimer: This content is for educational and informational purposes only. It should not be considered financial or investment advice. Always do your own research or consult with a licensed financial professional before making any investment decisions.