Three titans dominate Pakistan’s fertilizer fields, but only one is sowing the strongest fundamentals — let’s dig in.

The fertilizer sector has long served as a defensive stronghold for investors during economic volatility, and a dividend-rich favorite for long-term holders. But in a market where looks can be deceiving, payouts and profits alone aren’t enough. To truly assess the financial health of these companies, we need to go beyond the surface. It’s time to apply the forensic lens — through Piotroski F-Score and DuPont Analysis — to uncover who’s fundamentally strong and who’s just putting on a show.

while all three fertilizers boast their profits with dividend in the market not all are same. To differentiate fundamentally strong from superficially stable we turn to piotroski score and DuPont analysis.

DuPont Dissection and Piotroski Insight

Fauji Fertilizer Company

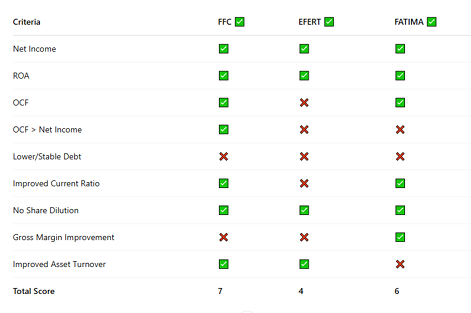

FFC boasts a strong Piotroski Score of 7/9, signaling solid financial foundations and consistent operational health. The company stands out with high profitability, strong operating cash flows, and improving liquidity, reflecting strength across key financial indicators. Its only soft spots lie in slightly elevated leverage and mild margin compression—both manageable concerns in the broader context of its performance.

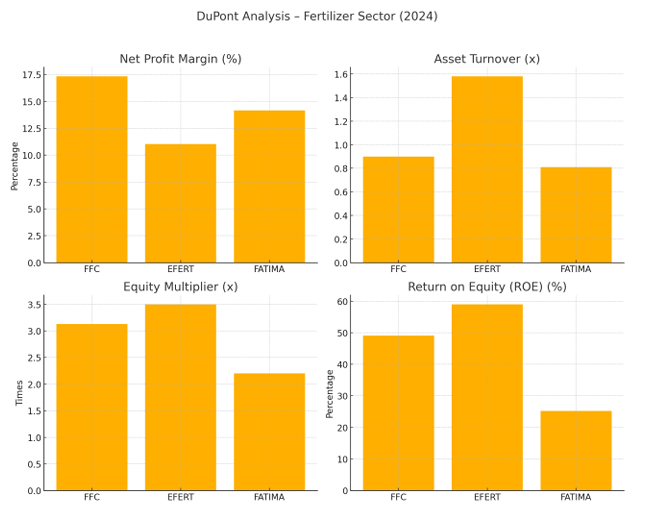

This financial robustness is further reinforced by FFC’s DuPont analysis, which showcases a remarkable ROE of 49.1%, driven by healthy margins, decent asset turnover, and a strategic use of leverage. The company’s 2024 performance, fueled by record revenues and merger synergies, affirms its ability to scale effectively without compromising returns. Taken together, these indicators position FFC as a fundamentally superior player in the fertilizer sector, offering a compelling case for investors seeking both stability and long term value.

Engro Fertilizers Limited

EFERT’s Piotroski Score of 4/9 paints a cautionary picture beneath its surface-level profitability. While the company showcases strong asset efficiency and the highest ROE (~59%) among peers, the underlying numbers suggest fragility. A major red flag is the presence of positive net income paired with negative operating cash flow, raising concerns about earnings quality. Additionally, a rising debt load and declining current ratio further weigh on its financial stability.

DuPont analysis confirms this duality — the impressive ROE stems from a high asset turnover (1.58×) and an aggressive equity multiplier (3.50×). EFERT is clearly using its assets efficiently and leveraging its balance sheet to amplify returns. However, its net profit margin of just 11.0%—the lowest among its peers—exposes pressure on profitability, especially after losing access to concessionary gas pricing. In short, while EFERT delivers top tier returns on equity, it does so by leaning heavily on leverage and operational efficiency, with weaker earnings quality and financial resilience remaining key concerns.

Fatima Fertilizer (FATIMA)

Fatima Fertilizer earns a Piotroski Score of 6/9, placing it in the middle ground — neither fundamentally weak nor exceptionally strong. The company shows positive signs in profitability, liquidity, and margin improvement, but concerns arise from declining operating cash flow, rising debt, and a drop in asset turnover, which suggest inefficiencies or underutilized assets. These trends indicate that while Fatima maintains a stable financial posture, it's losing some operational momentum.

The DuPont breakdown adds further clarity. Fatima posted a ROE of 25.2%, driven by a healthy net profit margin (14.17%), a modest asset turnover (0.81×), and a conservative equity multiplier (2.20×). Compared to its peers, Fatima uses less financial leverage, which speaks to a more prudent capital structure but also limits its return amplification. Despite record earnings growth in 2024, the company’s declining asset efficiency held back stronger ROE performance. In essence, Fatima stands out for its balanced approach and steady profitability, but it needs to enhance operational efficiency to keep pace with its more aggressive competitors.

Verdict

In a sector marked by volatility and rising input costs, Fauji Fertilizer Company (FFC) emerges as the most fundamentally sound player — combining strong earnings quality, efficient operations, and disciplined financial management. Its high Piotroski Score and impressive ROE make it a solid pick for long-term, value-focused investors.

Engro Fertilizer (EFERT), despite delivering the highest ROE, does so by leaning heavily on aggressive leverage and asset efficiency, while struggling with earnings quality and liquidity. It may appeal to short- to medium-term investors who can tolerate risk, but the red flags make it less appealing for conservative portfolios.

Fatima Fertilizer holds the middle ground — offering a balanced profile with good profitability and a safer capital structure. However, its declining efficiency and rising debt suggest it needs operational improvements to strengthen its long-term investment case.

The information provided in this blog is accurate and true to the best of our knowledge at the time of publication. However, errors, omissions, or changes in facts and circumstances may occur over time. Readers are encouraged to verify details independently

Disclaimer: This content is for educational and informational purposes only. It should not be considered financial or investment advice. Always do your own research or consult with a licensed financial professional before making any investment decisions.