So what was all the fuss about?

Sure, a near-10,000-point loss over three days, including an almost 5,000-point drop in a single day, is pretty severe and traumatic, but were all the blood-on-the-trading-floor premonitions of an epic crash that spread like fire on social media really warranted?

Let’s consider a few technical and a couple of exogenous factors.

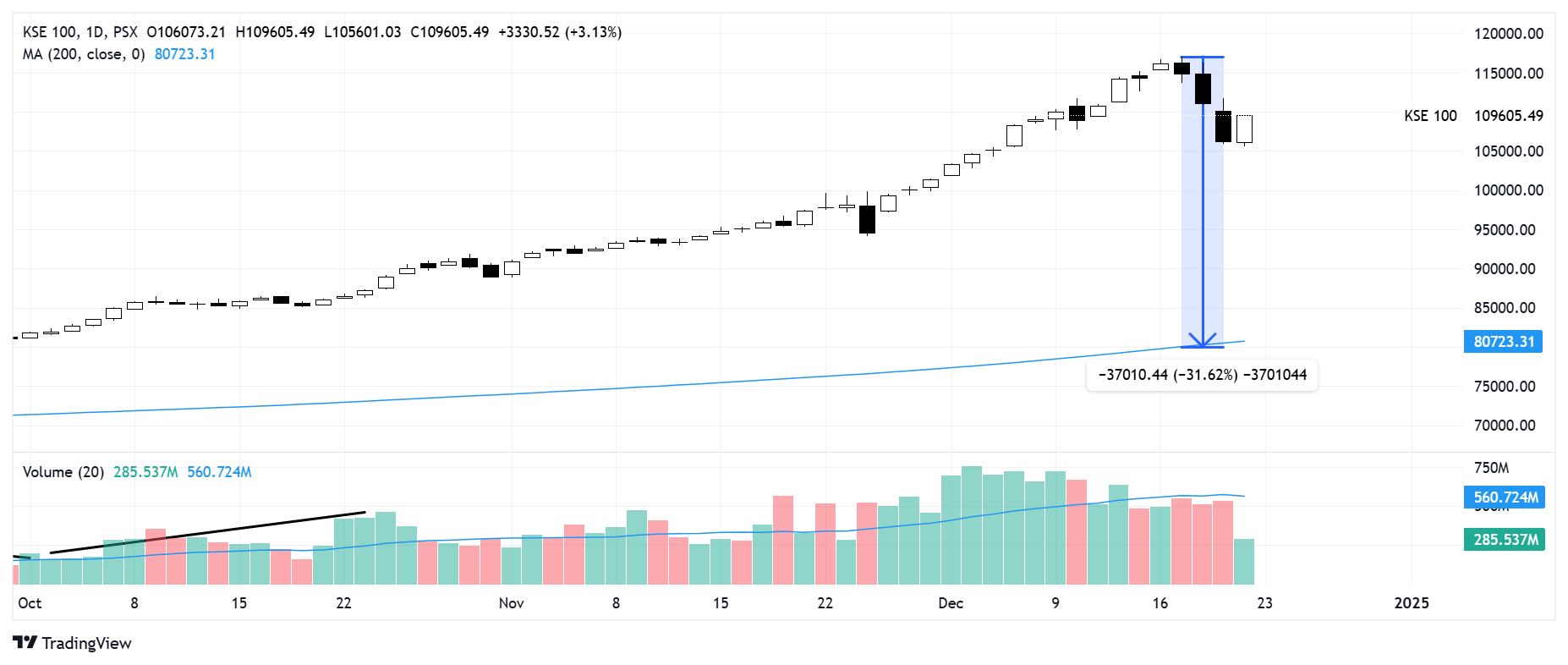

One, at its top, just before the turn triggered by the interest rate announcement, the market was almost 32pc above its 200-day simple moving average (more on this in a subsequent blog post). For perspective the S&P500, also experiencing historic, dizzying heights and also confronting interest rate-specific headwinds, was still under 10pc above its 200-day SMA at its peak.

Two, volatility as measured by the 14-period ATR (Average True Range) on the daily chart was, and is, hovering near the 3,000-mark for days and weeks; implying a move of that magnitude in either direction on any day – so long as volatility remained this high, of course.

And three, even though businesses were calling for a 400-500bp cut, the market knows not to expect more than the consensus which, in this case, was a 200bp cut – as cited by all leading brokerage houses. That explains, in part at least, why trading up to and immediately after recent MPC (Monetary Policy Committee) interest rate meetings has followed the textbook buy-the-rumour-sell-the-fact pattern.

Now let’s combine the three. What goes up has got to come down, and a move this far from the 200-day SMA – the classic benchmark for long term trends – does imply that a reversion to the mean, whenever triggered, is going to be extreme.

Also, considering the high ATR reading and the fact that the market was riding 2,000 to 3,000 points a day for days on end, it does make sense that it would correct with strong volatility whenever the turn comes, doesn’t it?

And with longs so long in a market that is relentlessly going one way, barely taking a breather to make a lower high, what better time to position for a little bit of profit-taking than an interest rate cut that has already been priced in? Especially since it also brings the added benefit of buying the dip for the next run up?

Now let’s add the exogenous factors as well.

Not much about the broader outlook has changed since this mini crash.

Inflation is still at a 6.5 year low. The Saudi loan rollover, soon to be followed by the Emiratis, will still make the state bank’s reserves look pretty. And political turbulence is declining with the government and opposition finally looking to talk out their differences.

Yet a little has changed as well.

The US government has sanctioned four Pakistani entities for alleged involvement in activities related to the proliferation of missile technology and violating international non-proliferation agreements. If not handled properly and promptly, such news can rattle the market.

A senior Trump advisor has also started openly calling for Imran Khan’s release on social media, and you can count on PTI’s online legions to raise hell with all such news.

Also, the most certain technical signals come from price action itself. And since the market has made a clear top and followed it with a version of three black crows (bearish candlestick pattern), the downturn – whether it's a hard correction on the way to a higher low or a major change in trend – will stay in effect till the top is again broken to the upside.

Till then, all analysis is purely conjecture.

Disclaimer: This content is for educational and informational purposes only. It should not be considered financial or investment advice. Always do your own research or consult with a licensed financial professional before making any investment decisions.

.png)